Search HS Code

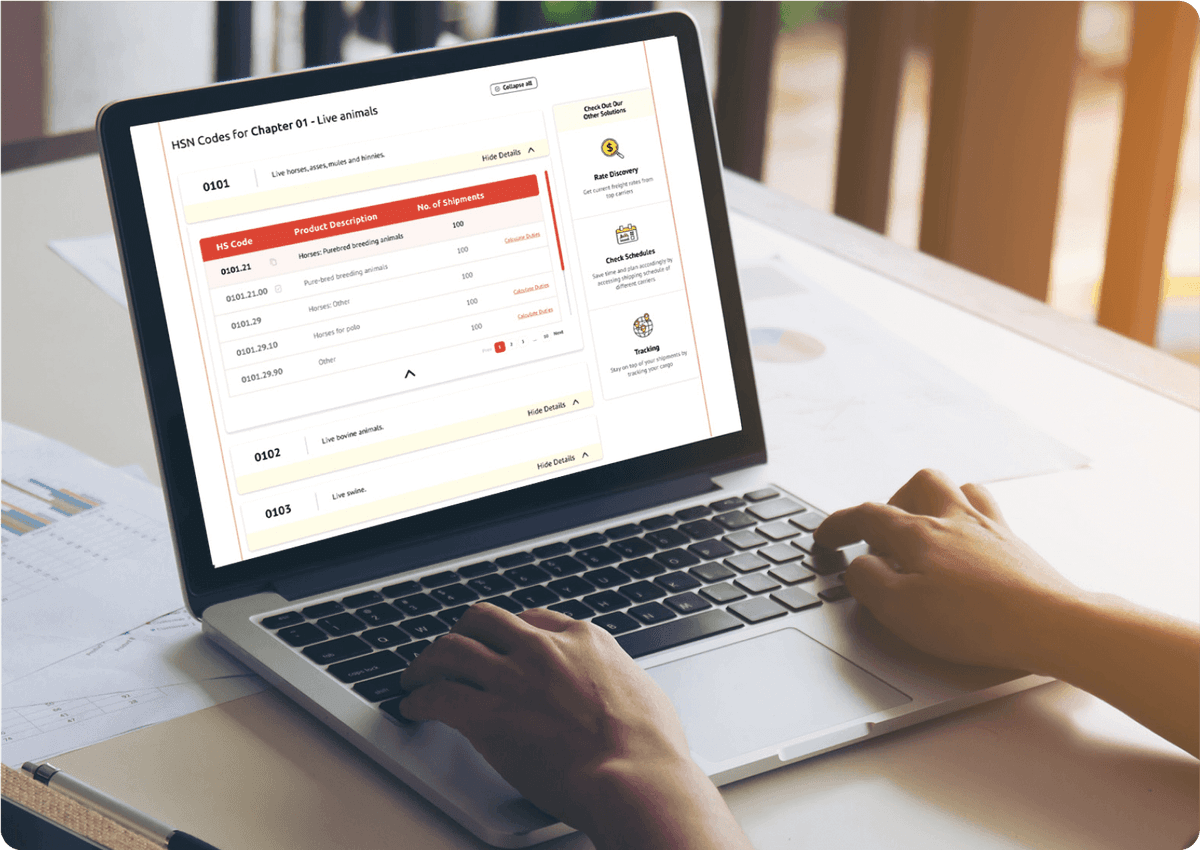

Find HSN Code or ITC HS Code and their GST Rates for your product with our HSN Code Search Tool. Search by either

product name or HSN Code. Use a category list as an alternative way to get to your products HS code.

Frequently Searched:

Cement

Battery

Furniture

Rice

Sugar

If you are in the business of exporting and importing goods, you would be familiar with the Harmonised Commodity Description and Coding System, better known as the Harmonised System (HS) or Harmonised System of Nomenclature (HSN). It is a universally accepted method of classifying traded goods. Its main function is to help customs authorities identify products and assess the right duties and taxes on them. In the Harmonised System, each product is assigned a unique numerical code called the HS code. This code has a minimum of six digits and can typically go up to 10 digits (though China has a 13-digit code).

What is harmonized system?

A way to identify any product with a 6 digit code

First 2 digits identify the chapter the product falls into

The next 2 digits identify a heading with that chapter

The last 2 digits denote a sub-heading making it more specific

There is an example on the right

Coffee

HS Code: 090111

Chapter: Coffee, Tea, mate & Spices

Heading: Whether or not roasted or decaffeinated, coffee husks and skin, coffee substitutes containing coffee in any proportion

Subheading: Coffee, not roasted,not decaffeinated

09

01

11

Correct HS code ensures

You pay the right duty

You receive the benefits you are eligible for, such as a suspension of customs duty

You are informed of whether your product attracts anti-dumping duty, requires a special licence to be shipped or comes under a trade quota

Incorrect use may cause

Steep fines and penalties imposed by customs authorities

Denial of import-export privileges

Denial of refund or a lengthy process to claim a refund if you have paid a higher rate of duty

Payment of duty difference plus interest if you have underpaid

06

Live trees and other plants; bulbs, roots and the like; cut flowers and ornamental foliage

07

Edible vegetables and certain roots and tubers

08

Edible fruit and nuts; peel of citrus fruit or melons

09

Coffee, tea, maté and spices

10

Cereals

11

Products of the milling industry; malt; starches; inulin; wheat gluten

12

Oil seeds and oleaginous fruits; miscellaneous grains, seeds and fruit; industrial or medicinal plants; straw and fodder

13

Lac; gums, resins and other vegetable saps and extracts

14

Vegetable plaiting materials; vegetable products not elsewhere specified or included

16

Preparations of meat, of fish, of crustaceans, molluscs or other aquatic invertebrates, or of insects.

17

Sugars and sugar confectionery

18

Cocoa and cocoa preparations

19

Preparations of cereals, flour, starch or milk; pastrycooks' products

20

Preparations of vegetables, fruit, nuts or other parts of plants

21

Miscellaneous edible preparations

22

Beverages, spirits and vinegar

23

Residues and waste from the food industries; prepared animal fodder

24

Tobacco and manufactured tobacco substitutes; products, whether or not containing nicotine, intended for inhalation without combustion; other nicotine containing products intended for the intake of nicotine into the human body

28

Inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals, of radioactive elements or of isotopes

29

Organic chemicals

30

Pharmaceutical products

31

Fertilisers

32

Tanning or dyeing extracts; tannins and their derivatives; dyes, pigments and other colouring matter; paints and varnishes; putty and other mastics; inks

33

Essential oils and resinoids; perfumery, cosmetic or toilet preparations

34

Soap, organic surface-active agents, washing preparations, lubricating preparations, artificial waxes, prepared waxes, polishing or scouring preparations, candles and similar articles, modelling pastes, «dental waxes» and dental preparations with a basis of plaster

35

Albuminoidal substances; modified starches; glues; enzymes

36

Explosives; pyrotechnic products; matches; pyrophoric alloys; certain combustible preparations

37

Photographic or cinematographic goods

38

Miscellaneous chemical products

50

Silk

51

Wool, fine or coarse animal hair; horsehair yarn and woven fabric

52

Cotton

53

Other vegetable textile fibres; paper yarn and woven fabrics of paper yarn

54

Man-made filaments; strip and the like of man-made textile materials

55

Man-made staple fibres

56

Wadding, felt and nonwovens; special yarns; twine, cordage, ropes and cables and articles thereof

57

Carpets and other textile floor coverings

58

Special woven fabrics; tufted textile fabrics; lace; tapestries; trimmings; embroidery

59

Impregnated, coated, covered or laminated textile fabrics; textile articles of a kind suitable for industrial use

60

Knitted or crocheted fabrics

61

Articles of apparel and clothing accessories, knitted or crocheted

62

Articles of apparel and clothing accessories, not knitted or crocheted

63

Other made up textile articles; sets; worn clothing and worn textile articles; rags

72

Iron and steel

73

Articles of iron or steel

74

Copper and articles thereof

75

Nickel and articles thereof

76

Aluminium and articles thereof

78

Lead and articles thereof

79

Zinc and articles thereof

80

Tin and articles thereof

81

Other base metals; cermets; articles thereof

82

Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal

83

Miscellaneous articles of base metal

86

Railway or tramway locomotives, rolling-stock and parts thereof; railway or tramway track fixtures and fittings and parts thereof; mechanical (including electro-mechanical) traffic signalling equipment of all kinds

87

Vehicles other than railway or tramway rolling-stock, and parts and accessories thereof

88

Aircraft, spacecraft, and parts thereof

89

Ships, boats and floating structures

94

Furniture; bedding, mattresses, mattress supports, cushions and similar stuffed furnishings; luminaires and lighting fittings, not elsewhere specified or included; illuminated signs, illuminated name-plates and the like; prefabricated buildings

95

Toys, games and sports requisites; parts and accessories thereof

96

Miscellaneous manufactured articles

.jpg&w=828&q=75)